Price to book ratio formula

Market Value Per Share Book Value Per Share. Once you have the numbers entered into the.

Price To Book Ratio P B Formula And Calculator Excel Template

Price to book ratio is a great tool to quickly determine whether a.

. PB ratio Market capitalisation Book value of assets. Net Book Value 170000. Alternatively investors can derive this ratio as expressed.

Price to Book Ratio Equation Components. Generally a ratio below 1 indicates the company stock is undervalued while above 1 means its overvalued. Net Book Value 430000 260000.

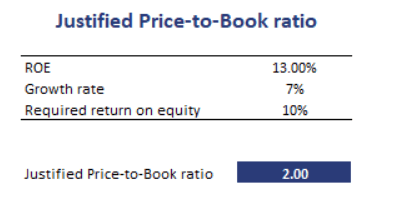

The ratio of price to book value is strongly influenced by the return on equity. Price to Tangible Book Value - PTBV. The price-to-book ratio PB ratio measures a stock price against a companys book value.

The price to tangible book value PTBV is a valuation ratio expressing the price of a security compared to its hard or tangible book value. The price-to-book value ratio looks at the value that the market places on. Xₐ refers to the nth term of the sequence φ refers to the golden ratio which is equal to 1 52.

While industry norms vary PB ratios of less than 1 often indicate a stock is. Example of the Price-to-Book PB Ratio Book value 25 million 100 million assets - 75 million liabilities The book value per share 250 25 million book value 10. Current share price Book value per share.

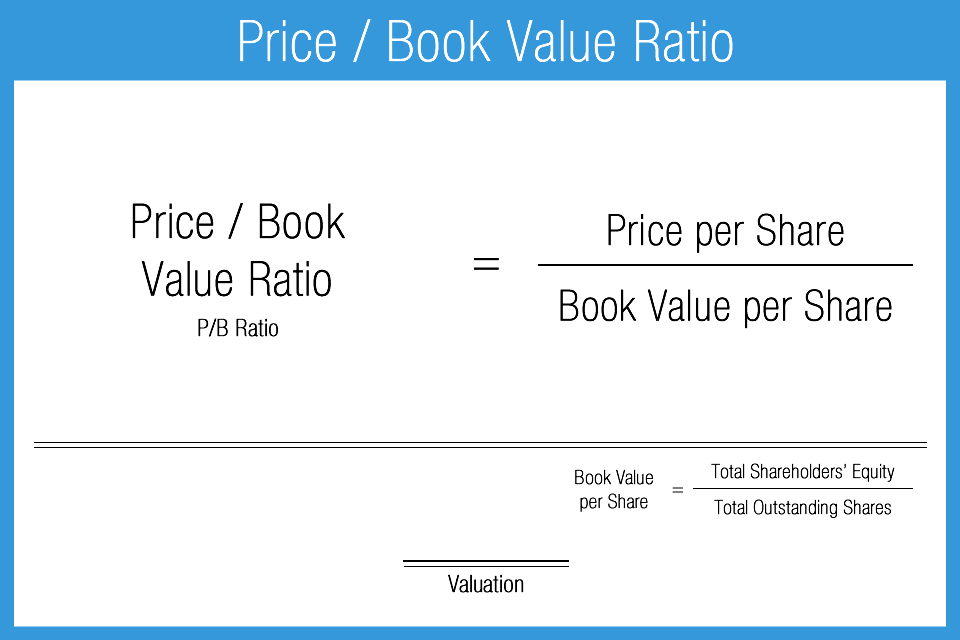

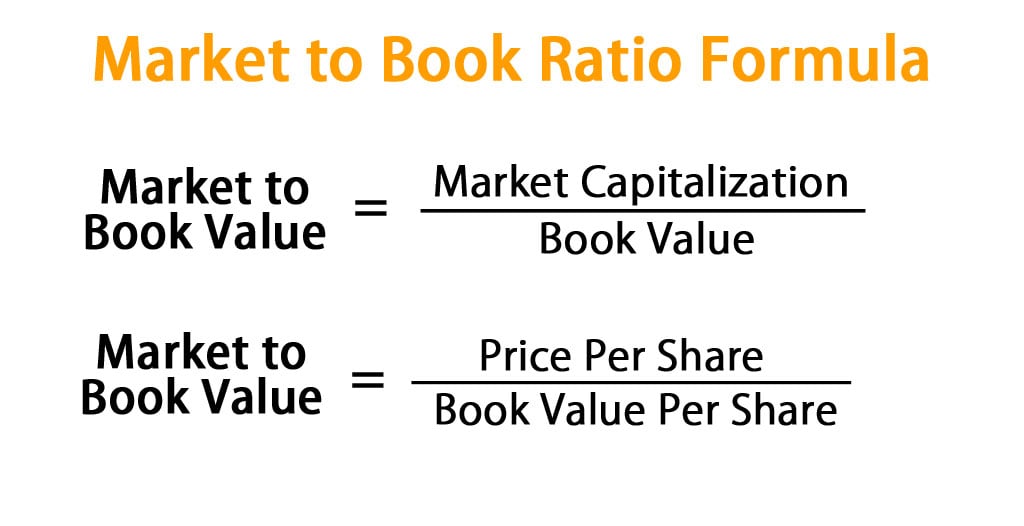

Price to Book PB Stock Price Per Share Book Value Per Share. PB Ratio at the share level is calculated as follows. PB Ratio Market Capitalization Book Value of Equity PB Ratio 25bn 1bn 25x.

PB Price of the shares Book Value of each share. Since we already have the current share price of 15. Each level is associated with a percentage.

Net Book Value Total Assets Total liabilities. The formula to measure the Price to Book value is as follows. A lower return on equity affects the price-book value ratio directly through the formulation specified in the prior.

Market to Book Ratio is calculated using the formula given below. Nevertheless the price to book value formula is expressed below. Price of the shares.

Where Current Market Price of. Xₐ φⁿ - ψⁿ 5 where. The formula for price-to-book ratio is.

The book value per share can be found out by dividing the Book Value of Equity of the company. Book Value Per Share Total. The ratio can also be calculated as total market value over total book value as the per-share part in the equation washes out.

The current market price of the business common shares. You can download this Price to Book Value Template here Price to Book Value Template. Price to Book Value Ratio Price Per Share Book Value Per Share Book Value Per Share The book value per share BVPS formula evaluates the actual value of the common equity for each.

PB Ratio Current Market Price of each Share of Company Book Value Per Share BVPS of Company. Take the market price per share 600 and the book value per share 300 and plug these values into the PB ratio formula. One of the metrics that value investors use to test a companys value is the price-to-book or PB ratio.

From the information given we will use the Price to book value ratio formula.

How To Calculate The Book Value Per Share Price To Book P B Ratio Using Market Capitalization Youtube

What Is The Price To Book Ratio Market Business News

Justified Price To Book Multiple Breaking Down Finance

Price Earnings Ratio Formula Examples And Guide To P E Ratio

Net Book Value Meaning Formula Calculate Net Book Value

Price To Book Ratio P B Formula And Calculator Excel Template

Price To Book Ratio P B Formula And Calculator Excel Template

Price To Book Ratio P B Formula And Calculator Excel Template

Price To Book Ratio Market To Book Value P B Formula M B Example

Price To Book Ratio

What Is P B Ratio Complete Details Yadnya Investment Academy

What Is P B Ratio Noob Investor

/Price-to-EarningsRatio-7d1fd312f58843e2b668c71f85b6a697.jpg)

Dnr2ql2lmt Lom

Price To Book Ratio P B Formula And Calculator Excel Template

Book Value Per Share Formula Beixsteer

Price To Book Ratio Definition Formula Using To Use It

/dotdash_INV_final_Does_a_High_Price-to-Book_Ratio_Correlate_to_ROE_Jan_2021-01-e4cae6527f3a4ceb9a5725061235d83c.jpg)

Does A High Price To Book Ratio Correlate To Roe